Link PAN Card with Aadhaar

It has been made mandatory to link your PAN card with Aadhaar. Your income tax return would not be processed if your Aadhaar is not linked with PAN. Linking of your PAN with Aadhaar is also indispensable if you are carrying out banking transactions for an amount of Rs.50,000 and above.

According to the IT Department, if you do not link your PAN to Aadhaar, then it will become invalid under Section-139AA of the Income Tax Act. And once it becomes invalid, you will not even be able to file ITR online and your tax refund may get stuck. Apart from this, you will not be able to use PAN in any financial transaction.

As per latest Govt. of India directive, if you fail to do PAN Aadhaar linking, your PAN will become ‘inoperative’ after March 31st, 2022.

As per announcement made by Central Board of Direct Taxes (CBDT), the deadline to link PAN with Aadhaar has been extended from 30th September 2021 to 31st March 2022.

If the PAN card is not linked to Aadhaar, an individual will also not be able to invest in mutual funds, stocks or open a bank account among other things as furnishing a PAN card in all those cases is a must.

How to Link PAN Card with Aadhaar ?

Linking PAN card with an Aadhaar card is very simple and you can link your Aadhaar number with PAN in any of the two ways:

Step 1: Using the SMS facility

Step 2: Using facility on e-Filing portal https://incometaxindiaefiling.gov.in

How to Link PAN Card with Aadhaar via SMS ?

To link PAN with Aadhaar by sending an SMS, you need to follow the steps mentioned below:

Step 2: Send it to 567678 or 56161

Example: UIDPAN 123456789123 ABCDE1234F

How to Link PAN Card with Aadhaar via Income Tax e-filing website ?

Here is the procedure to link your pan card with Aadhaar through Income Tax e-filing website

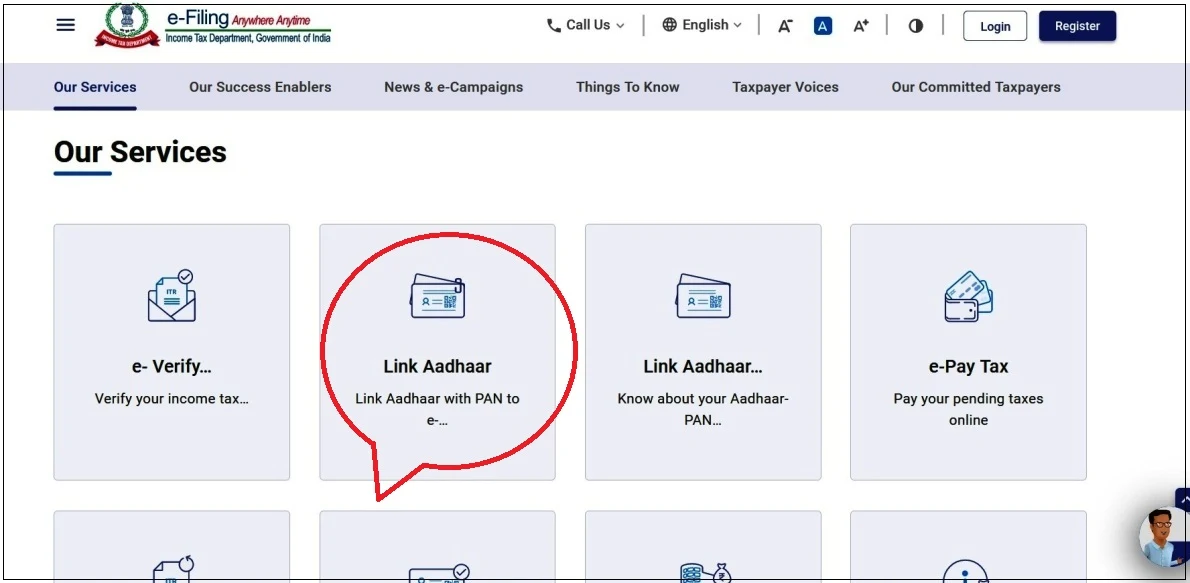

Step 1: Go to www.incometax.gov.in . Scroll down to reach the ‘Our Services’ tab.

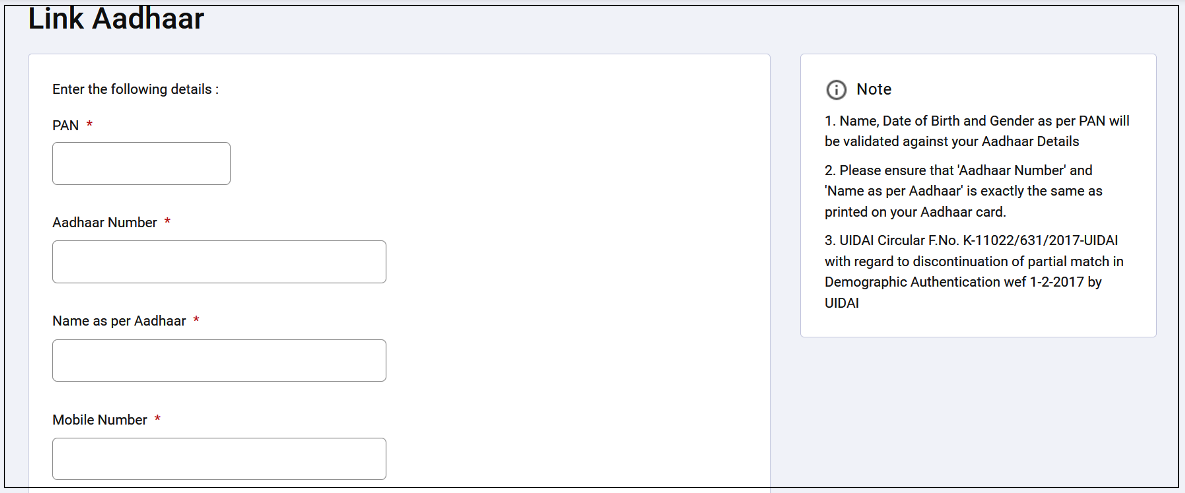

Step 3: Enter your following credentials

# PAN;

# Aadhaar no.,

# Name as exactly specified on the Aadhaar card and

# Mobile number

In case if only year of birth is mentioned in your Aadhaar card, then select the check box asking “I have only year of birth in Aadhaar card”.

Tick on the box that says, “I agree to validate my Aadhaar details”. It is mandatory to select this check box to proceed further for Aadhaar linking.

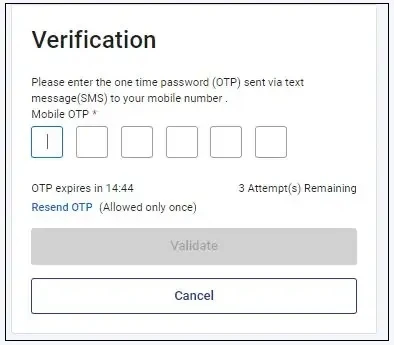

Step 3: Click on "Link Aadhar" tab .

How to Check the Status of PAN Card link with Aadhaar ?

Here is the key steps to check whether your PAN Card is linked with Aadhaar successfully or not.

Step 1: Visit the Income Tax Department’s official website and go to Aadhaar Status or click on the link incometaxindiaefiling.gov.in/aadhaarstatus.

Step 2: Enter your PAN and Aadhaar Number.

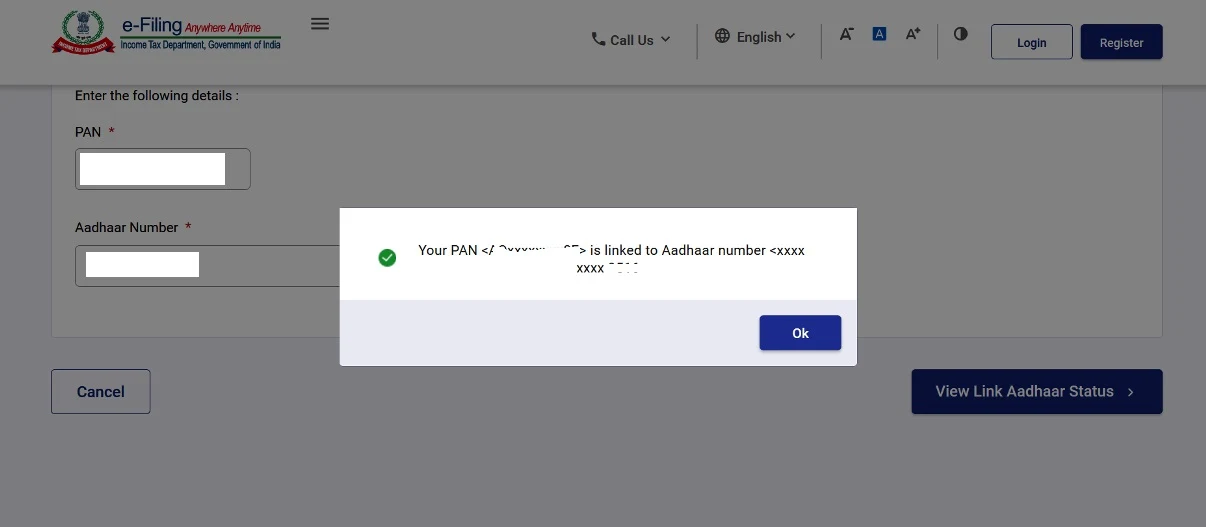

Step 3: Next click on ‘View Link Aadhaar Status’.

Step 4: If it was already linked, a message will be popped up - "Your PAN <XXxxxxxxxxXX> is linked to Aadhaar number <xxxx xxxx xxxx> "

Important Web-Links of PAN – Aadhaar Linking

| Link PAN Card with Aadhaar | Click Here |

| Check PAN Aadhaar Link Status | Click Here |

| Official Website | Click Here |

Consequence of not Linking PAN – Aadhaar

An individual who does not link their Aadhaar card with a PAN card by March 31, 2022 stands to lose the operability of their PAN card. It is to be noted that a PAN Card is needed to fulfil Know Your Customer (KYC) norms from clearing houses to banks and even e-wallets. If a PAN card becomes, all these services will invariably be affected.

An inoperative PAN card will affect one's bank account savings as the interest earned on your bank account savings. The TDS (Tax Deduction at Source) levied on interest beyond Rs 10,000 annually will double to 20 per cent in the event of bank not being linked to PAN Card. The TDS levied on interest beyond Rs 10,000 for bank accounts linked with PAN card is 10%.

Also, a penalty of Rs 10,000 may apply under Section 272B of the Income Tax Act, if you fail to link the two documents by the deadline and your PAN becomes inoperative and it will be assumed that your PAN has not been furnished as required by the law.

Even if you miss the deadline, you can still link PAN-Aadhaar but with a penalty of Rs 1,000 and other consequences as well.

An inoperative PAN card will affect one's bank account savings as the interest earned on your bank account savings. The TDS (Tax Deduction at Source) levied on interest beyond Rs 10,000 annually will double to 20 per cent in the event of bank not being linked to PAN Card. The TDS levied on interest beyond Rs 10,000 for bank accounts linked with PAN card is 10%.

Also, a penalty of Rs 10,000 may apply under Section 272B of the Income Tax Act, if you fail to link the two documents by the deadline and your PAN becomes inoperative and it will be assumed that your PAN has not been furnished as required by the law.